How to Dispute Cancer Care Costs

A Practical Approach to Disputing Cancer Care Expenses, Backed by Experts and Real Patient Experiences

Edited by:

Katrina Villareal

Navigating the costs of cancer treatment can be overwhelming. This live conversation provides practical tips from experts and real cancer patients on understanding your health insurance, finding financial assistance programs, knowing your rights to appeal insurance decisions, and reducing financial toxicity.

In this conversation, we’ll explore the fundamentals of health insurance, emphasizing the importance of reading and understanding your policy, including basic insurance terms. Discover your rights as a cancer patient, learn strategies for appealing insurance decisions, and explore avenues for applying for financial assistance.

Hear from Abigail Johnson, a stage 4 metastatic breast cancer patient advocate, and attorney, Gregory Proctor, a multiple myeloma patient advocate, and Monica Fawzy Bryant, a cancer rights attorney and co-founder of Triage Cancer, as they share real-world experiences, health insurance tips, and strategies for tackling financial toxicity to help you navigate the financial aspects of cancer treatment. This live conversation took place in November 2023.

This interview has been edited for clarity and length. This is not medical advice. Please consult with your healthcare provider for treatment decisions.

Introduction

Abigail Johnson: Hello, everyone, and welcome to a discussion of how to dispute cancer care costs sponsored by The Patient Story and including representatives of patients experiencing this individually, as well as a representative from Triage Cancer.

The Patient Story’s tagline is Human Answers to Your Cancer Questions. Founded by a cancer survivor who took her love of storytelling and producing videos, they assist people in the cancer community to get that all-important peer support and information about how other people have handled something that you as an individual might be facing yourself.

Without further ado, I want to get to the amazing people that we have talking about this very human issue, which is getting your cancer care costs covered.

Gregory Proctor: My name is Gregory Proctor. I’m a multiple myeloma survivor diagnosed back in July 2021. In the early stages, it was very overwhelming and very impactful not only emotionally but physically. Coming from a project management background, one of the things was trying to figure out how to navigate.

Information is not easily found in a lot of cases because if you Google things, you tend to get the bad before you get the good. But overall, my professional experience as well as having friends and family to help me move this forward has provided an overall successful outcome.

I’m proud to say that I’m still MRD negative, thriving, in remission, and continuing to flourish and be an advocate.

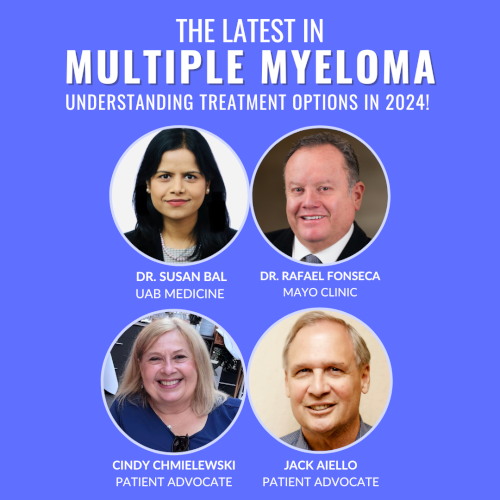

Monica Bryant: My name is Monica Bryant. I’m a cancer rights attorney and co-founder and chief operating officer for Triage Cancer, which is a national nonprofit dedicated to providing free education on legal and practical issues that arise after a cancer diagnosis. We provide education to the individuals who have been diagnosed, their caregivers, and healthcare professionals who are often on the front lines of getting these questions.

Abigail: Thank you, Monica. Y’all wrote the book on cancer and the law. What’s the name of that again?

Monica: It’s Cancer Rights Law and it is published by the American Bar Association.

It isn’t written for lawyers because we wanted to make sure that it was written in a way that was accessible for anybody to be able to access it — whether it’s the person who’s been diagnosed, their caregivers, lawyers who are trying to help out, or healthcare professionals. It’s written in a way that anybody should be able to pick it up, regardless of whether or not they have a law degree.

Abigail: I enjoyed reading it very much.

Like Monica, I’m also a lawyer, and in 2017, I was diagnosed with stage 4 metastatic breast cancer. I was 38 and it was, to put it nicely, a bombshell that went off in our lives and has changed everything since that has happened.

I’m working on getting into a clinical trial, which will be my sixth line of treatment. With breast cancer, because it’s a solid tumor, we don’t go into remission. That’s not necessarily a status or a goal for us. It doesn’t necessarily apply to our experience.

There can be no evidence of disease or, in my case, no evidence of active disease. I have been able to get to that point at least once in the last six years but I’m back getting a new treatment. For us with metastatic breast cancer, we go from treatment to treatment to treatment. There are a few that can go off treatment for some time.

I’m learning to adjust to being a professional patient, I like to call myself, because managing cancer itself can be a full-time job and that’s why discussions like this are very important because our quality of life, and Gregory alluded to this, is very much tied to not just how the cancer cells are being controlled in our bodies by the medication but also impacted by how we can get to that treatment, whether it’s literal transportation to get to that treatment or being able to afford cancer treatment.

Here in the US, cancer is quite the machine in a lot of ways. There are a lot of different players and moving parts. Our goal is hopefully to illuminate some of those moving parts, at least when it comes to covering the cost of cancer care.

Managing cancer itself can be a full-time job.

Abigail Johnson

Health Insurance

Abigail: This concept of covering cancer care a lot of times boils down to insurance. In my experience, being on a private insurance plan through my husband’s employment as well as Medicare, the first thing that I always talk to people about is getting a copy of the insurance contract. That can be daunting for a lot of people because these contracts can be 200 or 300 pages long. They are written by lawyers and many clauses can be super complicated.

If this seems daunting, intimidating, and confusing, it is. It absolutely is. It is for the professionals that are working in this arena. Getting your insurance contract, whether you have a government-sponsored insurance policy, whether you’re working with the Veterans Affairs and have coverage there, whether it’s Medicare, some documents explain what is covered.

When it’s private insurance, it is a literal contract between you and the insurance company, and it spells out what they’re going to do and not do. In my experience, there are about 10 pages that are vital for me to know out of the 300-page long contract. I have those pages highlighted, bookmarked, saved, and written all over.

I continually go back to those pages to see the clauses and the language that govern what my insurance company is supposed to do. I set my expectations based on what my insurance company is supposed to do, and then I know if they have or not.

It’s important to know what tier your medication falls in because that impacts the cost of your copay.

Abigail Johnson

Many times, a medication, a surgery, or a procedure has to have prior authorization. The medical professional has to get with the insurance company and say, “We want to do X,” and the insurance company has to look over that and opine whether or not that is medically necessary. I won’t get started about how that is practicing medicine on the part of the insurance company, but that’s the system that we have.

My insurance company has 24 hours to respond to a prior authorization request from my medical team. That’s important for me to know because if there’s a delay, I can call the insurance company and say, “My doctor sent you a fax 48 hours ago. You had 24 hours to respond. This needs to rise to the top. You need to deal with this right away because you’ve not responded in the timeline that we anticipate.”

That’s one example of how knowing what my policy says, who’s supposed to do what, and when they’re supposed to do that helps me set my expectations. I’m not fussing at my doctor’s office if it’s not their responsibility and I’m not fussing at the insurance company if my doctor hasn’t done what they’re supposed to do. Knowing when they have not done what they’re supposed to do, I can bring that to their attention and that means that will become more of a priority for my insurance company.

It’s important to know what tier your medication falls in because that impacts the cost of your copay. These are examples of things that are important to know about your insurance policy so that you know how to navigate that.

Gregory: I’ve worked with a lot of attorneys in my professional career, but I’m not one. I have always been a professional. I make my premium payment and expect that coverages are going to be there when I need them. Until something traumatic or something like cancer knocks on your door, you don’t realize the implications that you’re faced with.

We contacted my insurance company and they said, “Okay, we’re going to be able to help you move and navigate through this,” with all of the empathy and compassion that they try to give.

I’m 2 ½-3 months into treatment. I’m paying my $1,000 premium and doing everything I need to do, but I’m burning $22,500 a week. The billing department for my oncologist calls and says, “Mr. Proctor, we’re at a point where you’re a quarter of $1 million. We’re going to have to stop your treatment. Your insurance company hasn’t paid.”

I’m sitting here flabbergasted. I’m trying to fight for my life. I’m several months into my treatment and my doctor hasn’t received a single dollar from my private healthcare insurance. At that moment, I realized it wasn’t just about me fighting cancer. Now I’ve got to engage in something that you expect would be covered.

For me and my family, we had to turn the switch on and get laser-focused. Now it’s not just about the financial implications, insurance, and survival. We’ve got to look at all three with a critical eye.

Having the knowledge and knowing what to do with that knowledge to be able to save your life, save money, and avoid some of those pitfalls is extremely important.

Gregory Proctor

I had to contact the insurance company and say, “I need to see the full contract. I need to understand why you guys are not paying my doctor.” Their reason at that time was, “We have to go through an audit, Mr. Proctor. You’ve been healthy. You’ve never had any type of circumstance like this come along and then all of a sudden, now you go from 0 to $22,500 a week.”

To me, that wasn’t an excuse. I said, “I’ve never missed a premium. I’ve never missed a payment. I need this to occur for me on my behalf because I’ve done what I needed to do.”

Everyone comes from a different walk of life and sometimes knowing what to do as well as knowing how to do it becomes extremely important. One of the things that was formidably important for my wife and me was taking all of my project management experience and applying it to myself as the project so that we could cover all of the gaps.

As they always say, knowledge is power. In this particular case, having the knowledge and knowing what to do with that knowledge to be able to save your life, save money, and avoid some of those pitfalls is extremely important.

In most cases, those are not things that you think about when you’re thrown into the tsunami of cancer. You’re thinking how to get from day to day, from week to week. There’s a lot more involved and it all embodies getting yourself educated.

Abigail: Thank you for all of that, Gregory. You’re coming to this with all of the information and experience that you have. You’re going to do it as a project manager because that’s your background. Who you are, your strengths, and how you solve problems is going to be key.

Understanding Insurance Terms

Abigail: Monica, what are the top things that patients need to know when they’re looking at their insurance contract or how to get cancer care covered?

Monica: There are some things that people really should understand about their insurance long before there’s ever a diagnosis or a serious medical situation. But the unfortunate reality is that in this country, health insurance is confusing. There are going to be differences depending on the source of that insurance, whether that’s government insurance, through an employer, or a policy someone purchased on their own.

Based on studies that have been done, only about 4% of Americans understand the four most common terms used in health insurance policies. People don’t even understand the words. We’re not even talking about complex legalese here. We’re talking about the basic words because we’re never taught what those words mean.

There is an amount someone pays monthly to have health insurance and that’s the monthly premium. They’re going to pay that amount whether they go to the doctor or not. It’s like having car insurance all year but never getting into an accident.

Once someone starts utilizing their health care, there are going to be some additional costs and those costs are going to depend on the policy. Most policies have an annual deductible, a fixed dollar amount that someone has to pay before health insurance kicks in. Someone could have a $500 deductible or a $5,000 deductible. It’s all going to depend on the plan.

Once they’ve met that deductible, insurance kicks in and pays a percentage. That percentage is referred to as the cost share or the coinsurance. Here’s where it gets tricky because we have multiple names for the same thing. Cost share and coinsurance are the same thing, and that’s a percentage. If someone has an 80/20 plan, once they meet their deductible, insurance kicks in at 80%, but they’re still responsible for 20%. And when the treatment is expensive, 20% is still a huge dollar figure.

Based on studies that have been done, only about 4% of Americans understand the four most common terms used in health insurance policies.

Monica Fawzy Bryant

In addition to that percentage, many plans have copayments, which is a fixed dollar amount that is going to depend on the policy and also potentially on the service. Someone could have a $25 copayment to see the doctor, a $35 copayment to see a specialist, or a $250 copayment to go to the E.R. Figuring that out could be complicated.

The most important thing for every single person to know about their health insurance policy is if there’s an out-of-pocket maximum and what is it. Because in theory, that’s the most that someone is going to pay out of pocket for their care if they go to in-network providers for the year.

Understanding that allows us to figure out what you are going to have to be responsible for out of pocket in a worst-case scenario. The way you get to your out-of-pocket maximum depends on the plan, but often it involves adding up everything you’re paying towards your deductible, your copayments, and your coinsurance. It’s everything you’re paying out of pocket except the monthly premiums.

The reason this is so important on the front end is when people are making choices around their health insurance. We have the opportunity to do that every single year now, thanks to the Affordable Care Act and a whole bunch of other laws.

To be an effective shopper and consumer of health insurance, you have to understand those terms and be able to do the math concerning your out-of-pocket maximum.

Gregory: For me, that’s key. I always maintain a pretty healthy lifestyle. I don’t want to have to come up with $15,000 as a deductible. If I’m healthy and I still feel pretty good, I can go with a little less coverage. You take a little bit more risk.

I was diagnosed at the age of 50, which was not the best year to be diagnosed with multiple myeloma. The older I got, I began to get laser-focused in my mindset as it relates to my family of four and my insurance.

At the age of 50, I’m more susceptive to all of these things that maybe I don’t want to think about, but I need to be in a position to ensure that I’m covered holistically without any repercussions.

Abigail: It’s amazing how expensive everything is. One of the things about cancer treatment is the medication and prescription drug costs, which can be complicated. When you’re put on medication by your doctor, they don’t always tell you the price tag upfront. In the breast cancer world, many of the medications that we take will cost our insurance companies between $14,000 and $20,000 per month.

Copay Assistance Programs

Abigail: In the context of private insurance, there are often copay assistance programs, which pharmacists will often help patients apply for. These programs are offered by the drug manufacturers or pharmaceutical companies. They will also have foundations sometimes. But depending on your insurance, these programs apply differently.

For myself, having a private policy means I’m eligible for copay assistance programs. Those copays go from hundreds of dollars a month to zero, oftentimes depending on which tier of medication you’re on.

My friends who transitioned to Medicare are surprised to notice that those copay assistance programs are not always possible when you’re on Medicare and that’s where those foundations do come into play as well.

Gregory, how has that affected you in terms of paying for your medication and working with the VA, where your primary insurance is?

Gregory: I was in a unique category. I had private healthcare insurance with a national provider when I was first diagnosed. I had been away from the government programs for many years. Since I’d gotten out of the Navy, I hadn’t utilized any of their benefits.

I started going through this process and all of this funding that you don’t account for starts to show up at my doorstep. Blood work for $16,000, a test for $15,000, and I wondered what insurance is truly covering if these bills are showing up.

I was very lethargic and incoherent for five days a week for three and a half months because I was on chemo for five days a week, 6 to 8 hours per day, which was tough.

Once I finally got to the point of reckoning and saying it was time to get a hold of this situation, I found out that there are subsidy programs. Sometimes they’re publicly known, other times they’re not, particularly if you don’t ask. We started pulling our energy into how could we tap into maybe a program to be able to give us a grant and move forward.

On record today, I’ve spent $2.65 million. Navigating that journey was not easy… It’s overwhelming. You’ve got to get other people involved to help be your eyes and ears

Gregory Proctor

With private healthcare, there’s a little bit of leniency. By the time I was approved for government healthcare being a prior veteran, I couldn’t utilize those programs. It was a very delicate balancing act to ensure that going forward, I would be able to reap all of the potential benefits that I could not afford out of my pocket to maximize my overall primary care going forward.

Because on record today, I’ve spent $2.65 million. Navigating that journey was not easy. But certainly, you have to get laser-focused because no one is going to do it for you.

It’s overwhelming. You’ve got to get other people involved to help be your eyes and ears, to help address the questions of who, what, where, when, and how. Sometimes when you’re getting information from the doctors, you don’t want to accept the reality. Acceptance is always the key to making the first step in the progress of being able to battle and weather the storm.

Abigail: You have personally spent $2.65 million or your insurance company has spent that?

Gregory: I love to throw that number out there because people always say, “Oh my, what happened?” For clarification, that’s the running total. When you think about that number and go back to what Monica said. Whether you’re 70/30, 80/20, or 60/40, part of that expense is coming from you as the patient.

When you step into the throes of dealing with cancer, these are the things that you have to get laser-focused on very early on. Are you going to be successful coming out of the back side of this? Are you going to be bankrupt or dealing with the overall financial toxicity of what it does to you and how it changes your life?

Abigail: Thank you for that. Those are big numbers. Mine’s a little over $3 million so I’m tracking with you. I have not spent $3 million keeping me alive, but certainly between my family and the insurance company.

Monica: Thank you for your service, Gregory. I’m glad that the VA was helpful in this process for you because it’s deserved.

Financial Assistance for Cancer Patients

Abigail: Monica, would you like to talk a little bit more about financial assistance and how patients can go about getting help to cover their portion of these costs?

Monica: With respect to getting financial assistance, I would say don’t start there. That should not be step one when you see the big bills come in because there isn’t a whole lot to go around. As you both alluded to, there are some barriers depending on the type of insurance that somebody has.

Before someone goes down the path of trying to apply for financial assistance, there are some steps to take. Did the insurance company cover what they’re supposed to cover? That requires making sure you’ve waited until you’ve gotten your explanation of benefits, which is the letter from the health insurance saying this is what we’re going to cover and this is what you potentially owe. It’s about keeping track of your out-of-pocket maximums.

If someone understands what their out-of-pocket maximum is and what’s included in their out-of-pocket maximum, it can help them figure out how much they need from financial assistance. A lot of times, people get those prescription drug bills and don’t realize the prescription drug benefits are included. It doesn’t matter what their insurance company will pay or not. If you’ve hit your out-of-pocket maximum, they’re responsible for 100% of it.

Unfortunately, some additional steps fall into the laps of patients and family members before getting financial assistance.

Do a deep dive into what’s out there and what’s available. Even among the pharmaceutical companies, there might be different programs.

Monica Fawzy Bryant

With financial assistance, oftentimes people get tunnel vision when they’re thinking about sources of help. Abigail, you mentioned how expensive your monthly prescription drug is.

How am I going to get money? How am I going to get assistance to pay for that prescription drug? I’m on Medicare so I don’t have access to the same pharmaceutical programs that I did. What am I going to do now?

Are there other places you could potentially get help? Could you get mortgage assistance, utility assistance, or other types of financial assistance and then shift the money around? Anything that you set aside to pay for the mortgage or student loans can get shifted to help pay for prescription drugs.

Do a deep dive into what’s out there and what’s available. Even among the pharmaceutical companies, there might be different programs. Some companies can provide free drugs, some companies can provide assistance to pay copays. They all have different programs. Figuring that out is daunting.

At TriageCancer.org, we have a chart that lists most of the major cancer drugs, the pharmaceutical companies that make those drugs, and the various programs that they have to try to make it a little less daunting to go down the Google rabbit hole because that is stressful by itself.

You can look for other types of financial assistance or grants that might be out there based on the type of cancer you’ve been diagnosed with. Sometimes there’s even financial assistance for family members who might be acting as caregivers. We have a tool called Cancer Finances that has pulled those resources from trusted sources to make it a little easier. It’s still not easy but a little easier for people who are trying to seek out those sources of financial support.

Abigail: Great resources. I have sent so many people to Triage Cancer. If you have a Sam’s or a Costco membership, you don’t even use insurance when you go to your wholesale clubs. For a medication that I was previously on, my copay was $15, but if I got it without using my insurance company, it was $20, which boggled my mind. Unfortunately, that puts a whole lot of burden on the family to figure out some of those things.

Gregory, did you ever get assistance from a social worker to help you figure some of these things out? Was that something that was offered in your oncologist’s office?

The life that you know before and after cancer is totally different. Asking questions could be the differentiator in a lot of the things that we’re talking about.

Gregory Proctor

Gregory: Not in my oncologist’s office but as I was getting prepped for a stem cell transplant. As a patient, it is important for you to ask.

Seek out and ask as many questions as possible. What do I need to do? How do I need to do it? What resources? What assets? Even if your doctor doesn’t want to give you the answers, you need to continue to perpetuate that going forward because it’s your life. The importance of survival doesn’t have a price tag.

I looked at everything. My wife and I flipped everything upside down because, at that point in time, your life is already flipped upside down. The life that you know before and after cancer is totally different. Asking questions could be the differentiator in a lot of the things that we’re talking about.

Abigail: Thank you for saying that. I talk to so many patients all the time who are worried that asking questions might be offensive or upset their healthcare providers. While that is certainly a good human thing to think about, in a situation like cancer, it’s your life on the line so ruffling a few feathers doesn’t seem to be as important as getting the answers.

Appealing Insurance Decisions

Abigail: I want to talk more about denials or when the insurance company is asking for your doctor to jump through some hoops. I talked about prior authorizations. What happens when an insurance company says, “No, we don’t think that that is medically necessary,” or like in Gregory’s situation, “We need to examine this a little bit more,” that sort of thing?

I want to throw out a couple of things that I’ve learned along the way in dealing with private insurance. Typically, when a doctor gets prior authorization, the insurance company says no. Usually, you, as the insured, get a letter that says why they denied it. Your doctor typically gets the same letter. And then what?

Besides changing your mind and doing something different that your insurance company goes along with, in my experience, what’s next is your doctor has the opportunity to do a peer-to-peer discussion. This is covered in all the insurance contracts that I have seen, along with the definition of what a peer is.

Very early on in my cancer treatment, my doctor wanted to do a PET scan. For those of us with solid tumor cancers, PET scans are often the gold standard in terms of seeing where the cancer is and how metabolically active it is. This is a tool that doctors need to be able to make good decisions.

A doctor employed by my insurance company, who was a family doctor about five years out of medical school, deemed the PET scan not medically necessary.

By looking at my insurance policy, I learned that my insurance company was required, upon my asking, to provide a peer to my doctor. I realized that somebody who’s five years out of medical school, who has a small amount of experience, and who is in a specialty that has nothing to do with oncology does not meet the definition of a peer.

I learned that I could say to my insurance company, “I require you to provide a peer to talk to my doctor.” That conversation took five minutes.

In the first conversation where it was denied, my doctor spent 40 minutes trying to convince this doctor employed by the insurance company that what she was doing was standard of care. When she was able to talk to an oncologist — not an oncologist that had 30-plus years of experience, but somebody in the cancer world — it was a five-minute conversation and it was approved.

The first person that my doctor talked to was looking at a chart and the wrong category. She was looking at somebody who was stage 3 versus stage 4.

I’ve let my doctor’s offices and their staff know as they are scheduling that they can ask for a peer. Make sure it’s a peer who’s talking to your doctor.

By looking at my insurance policy, I learned that my insurance company was required, upon my asking, to provide a peer to my doctor.

Abigail Johnson

By looking at your insurance policy and understanding the definition of a peer, that one small thing can save your doctor time. That 40-minute conversation took my doctor away from seeing patients. The five-minute conversation was a whole lot more effective and efficient.

As an insured, you also have the option of filing an appeal. It can get involved and it’s a really heavy lift when it comes to attempting to explain to your insurance company why they are not following the contract.

Gregory, what experiences have you had in getting something covered, especially when you got that initial no?

Gregory: After burning $22,500 a week and hitting a cap, hearing the words, “We will cover this, but we won’t cover that,” meant, “We’ll cover you for the period of your transplant. However, if there are any complications, then that’s on you, Mr. Proctor.”

Going from my private healthcare and trying to get the VA to pick me up had already been denied by the VA. It was very frustrating very early on knowing that I would want it to go through the VA from the beginning, but I was denied and that’s just how the system works.

Their rationale was there was no service-related tie that could tie back to me being diagnosed with cancer. I had to get attorneys involved and justify what my job and MOS (military occupational specialty) was in the military. Going through that took a tremendous amount of time.

You can’t ever give up. You have to continue to push.

Gregory Proctor

For me, one of the things that I had to sink into throughout this whole journey is don’t ever give up. Find a will. Find a way to navigate. I had to go back through all of the tests to prove that I had multiple myeloma.

Once we proved that, I was able to get 100% coverage but that took approximately five months from the time that I was diagnosed up until I was getting ready to go into a stem cell transplant.

The best Christmas gift that my wife and I could have ever received in December 2021 was that letter from the VA saying they are now my primary healthcare provider and they will cover not only my stem cell transplant but all post-maintenance costs. We’re talking, “Hallelujah!”

That was well worth all of the effort, the headache, the anxiety, the concerns, and the worries to get to that point. But like I said, you can’t ever give up. You have to continue to push.

Abigail: Thank you for those reminders. It’s easy to give up, especially when there are a lot of roadblocks. I love how you mentioned that you realized you needed help and that getting a professional involved was important.

Legal Rights as Insurance Consumers

Abigail: Monica, would you talk a little bit about the legal rights that we each have as consumers and talk about those appeals and what services might be available to patients?

Monica: Gregory did a little bit of my job for me in that we don’t have to take no for an answer. The details around that will certainly depend on the type of insurance we’re talking about, whether it’s the VA, Tricare, Medicare, or Medicaid.

If we’re talking about private insurance, at the bare minimum, every single consumer is entitled to at least two levels of appeal. The first level is an internal appeal and that’s essentially where we go back to the insurance company and say we’d like you to reconsider.

The internal appeal can take a couple of different forms. It could be a written internal appeal where you’re providing documentation. It could also be what Abigail was referring to, which is a peer-to-peer conversation between two healthcare providers.

There are time limitations on when we as consumers get to file internal appeals. We usually get 180 days. Then there are time limitations on the insurance company to give a response depending on where somebody is.

In Abigail’s example, it was a denial of a prior authorization so the insurance company has to answer within 30 days. If you’ve already received the service and they’ve come back and said, “Nope, we’re not covering that,” then they get 45 days.

Here’s the problem. When we’re talking about cancer care specifically, a lot of times we don’t have 30 or 45 days to wait for an answer. What we as consumers need to understand is that we have the right to ask for an expedited appeal when the need for care is urgent, which it is in most cases when we’re talking about cancer care. The insurance company then has to answer within 72 hours. But people don’t know this. People don’t understand that they have this right.

If the insurance company ultimately comes back and still says no, we have the right to an external appeal and that’s where we go to an independent entity. It’s going to vary from state to state, but an independent entity will look at all the facts and all the medical evidence, and then make a decision as to whether or not the care is medically necessary.

People need to understand those words, medically necessary, are the legal standard on which the appeals will be decided. Is it medically necessary for you to get that service? The decision of the independent entity at these external appeals is binding on the insurance company.

We don’t have to take no for an answer. The details around that will certainly depend on the type of insurance we’re talking about

Monica Fawzy Bryant

I made it overly simplistic for this session. I understand that requires a lot of legwork and effort to get the doctors involved. I’m not minimizing any of that, but here’s what we know to be true.

Of the millions of claims that are denied every single year, 99.9% of them are never appealed. Yet we also know that when people do appeal, somewhere between 40 and 60% of the time is decided in favor of the patient.

When we’re talking about how to help people afford cancer care, I want to talk about appeals long before we get to financial assistance. If insurance is coming back and saying, “We’re not going to cover that,” for whatever reason, “You’ve hit your max,” “We think you’re too expensive,” “We don’t think you need your PET scan,” if you’re not appealing those denials, you’re essentially leaving money on the table.

Abigail: That is such a great point. When your insurance company knows that you will appeal and will not take their decision lying down, in my experience, they’re much less likely to deny things in the future. It’s really important to make it hurt and make it difficult for them.

I’m not talking about doing anything drastic. Take up a lot of their time. Be bold in saying what you need and in filing those appeals. In my experience, they typically won’t be as likely to deny something in the future.

Thank you for giving us those numbers, Monica, because those are shocking numbers, like the millions of dollars that Gregory and I were talking about earlier.

I’m going to do whatever it takes because I’m all about living. I still have a lot more life to live than to let cancer dictate and determine how that’s going to be for me.

Gregory Proctor

Monica: It’s also helpful to put into context for people who are already overwhelmed. They’re reaching capacity in what they can handle. They’re trying to survive. Now the lawyer is saying to go through this burdensome appeals process. The numbers are helpful, particularly around the number of successful stories, to make that additional burden almost worthwhile, so to speak.

Gregory: That’s the main reason why my mantra going through this was don’t ever give up. There’s got to be a will. There’s got to be a way. It may not be door A, it may be door B or door C, but you’ve got to keep asking those questions and ensure that you’re getting the answer that you need to move forward.

When my life’s at stake, it doesn’t matter to me if it’s $1 billion. I’m going to do whatever it takes because I’m all about living. I still have a lot more life to live than to let cancer dictate and determine how that’s going to be for me.

Financial Toxicity

Abigail: I want to talk about financial toxicity. We’ve thrown that word around a couple of times. I didn’t realize this, but in 2013, it was researchers at Duke University that coined the term financial toxicity to describe the financial hardship and distress that can result from the high cost of cancer treatment.

Their research showed how the burdensome out-of-pocket expenses associated with cancer care, such as copays and deductibles, can negatively impact a patient’s mental health and quality of life, leading to increased anxiety, stress, and depression.

We hear all the time that stress is not good for patients. Stress is not good because it changes chemical things in your body. It makes your quality of life more difficult when you are stressed out. Then here comes our medical system that causes stress on us.

Gregory, how have you handled the mental toll of those bills and the financial stress? How do you handle that emotionally, too?

At one point in my life, I was questioning whether or not I would be able to afford groceries that week. That’s when you know the toxicity has gotten hold of you.

Gregory Proctor

Gregory: You’ve got to be willing to accept that this is your reality. That’s the first step in going forward with any type of traumatic or life-altering things that are happening.

The other aspect that became very, very important for me personally was stepping away from the notion of dealing with cancer 24 hours a day, seven days a week. One of the most therapeutic things that I did during my cancer battle was getting out in nature, walking on the trails, and separating my mind from the overall objective of having this wreak havoc on me.

With all of the debt and bills coming in, your life still goes on. You still have your normal expenses and now you’ve got cancer expenses and all these other things that happen. At one point in my life, I was questioning whether or not I would be able to afford groceries that week. That’s when you know the toxicity has gotten hold of you. You’ve got to navigate and weather the storm to figure out how to maneuver and move forward.

I’ve done a lot of things to get through that and find assets and various other elements in my life that I could move forward without having so much of the burden of the debt wreak havoc on me.

Abigail: Thank you for sharing that. I tell my medical teams all the time that I have to fit cancer care into my life not fit my life into cancer care. It’s a paradigm or a different way of looking at things that I think makes us as patients address some of these things a little bit differently.

Monica, would you talk a little bit about resources that Triage Cancer has or strategies for managing medical bills and finances so that people can have a good quality of life?

Monica: It’s at the core of what Triage Cancer is about. We have tons of educational resources in a variety of formats because we’re trying to meet people where they are and how they learn. Some people are big readers and that’s how they’re going to absorb information so we have quick guides and longer practical guides that can be downloaded and read off our websites.

We have live events that people can join for free, both in person and virtually. We also have worksheets, animated videos, and other materials to help people with things that can contribute to financial toxicity.

Health insurance status and navigation are only one piece of the puzzle. Certainly, employment changes that can occur after a diagnosis are going to impact somebody’s finances. Everything that normally happens in life that impacts finances keeps happening. You don’t get a pause button on paying the mortgage.

When you look at TriageCancer.org, you will see a variety of topics around health insurance, employment, and disability insurance to address holistically the financial impact that cancer and cancer care can have on people. When thinking about how to maximize health insurance, people need to remember a couple of things.

Every single year, we have the opportunity to make choices. If someone is experiencing high out-of-pocket expenses due to their insurance this year, there may be opportunities to pick a different source of insurance for the coming year.

Open enrollment for Medicare is coming up at the end of the year and that’s an opportunity to make some different choices — whether that’s finding a plan with a lower out-of-pocket maximum, a plan that has more of your providers in their network so they’re being covered at higher rates, or has a different prescription drug formulary so any prescription drugs you’re taking may be covered at a better rate.

You may be experiencing high financial toxicity right now based on the type of insurance you have, but there may be opportunities to make those changes for the coming year. We have resources at Triage Cancer to help you make those determinations.

When you look at TriageCancer.org, you will see a variety of topics around health insurance, employment, and disability insurance to address holistically the financial impact that cancer and cancer care can have on people.

Monica Fawzy Bryant

We also have a legal and financial navigation program where people can fill out a form and they’ll get a calendar link where they can schedule a call with one of our staff. We’ll talk through their situation and the sources of financial toxicity. We’ll try to provide them with personalized education and information about what they need to know and understand, point them in the right direction, and give them action steps. You can read quick guides all day long, but you may still have questions about your situation.

Abigail: Those are wonderful resources. I’ve sent all kinds of people to Triage Cancer and they’ve helped them figure things out and navigate those things.

Since Monica was talking about open enrollment and the possibility of adjusting your coverage, working with a good insurance broker can also be a tremendous help, especially when you’re going on Medicare. There are all these supplements and different options. Working with somebody who can take your situation, your doctors, your medication, and your diagnosis, and help you back into those policies that would meet some of those needs.

Typically, brokers are paid by the companies so you are not out of pocket any amount of money when you work with an insurance broker. That’s one thing that I suggest to a lot of people, especially those transitioning from private insurance to Medicare because it can be complicated with all of the different supplements.

Monica: I actually would give the opposite advice to somebody and that’s based on reports that have come out of the U.S. General Accountability Office. Over the last several years, many insurance agents and brokers have misbehaved in several ways. Now, certainly, that is not all of them. There are wonderful insurance agents and brokers out there so I’m not disparaging the profession as a whole by any stretch of the imagination.

Oftentimes, people can be led down a path that may not be the best for them. Those agents and brokers are paid by the insurance companies so they have a vested interest in enrolling people in specific insurance policies, even if those aren’t the best policies for that patient.

For the cancer community, where there is a heightened importance of making sure they are in the right plan for them, we would suggest unbiased sources of support and there are different places that people could go.

You might get a very different answer from an insurance broker versus a social worker who is employed by your cancer center. Getting different input can be important.

Abigail Johnson

If someone is transitioning to Medicare for the first time, every single state has a SHIP program, which is the State Health Insurance Assistance Program. They’re called different things in every single state. They are trained to help people navigate their Medicare options and they are unbiased. They do not get paid by enrolling people in one plan over the other.

For people who are buying insurance in the marketplace, there is a similar entity called In-Person Assistors. Again, they are paid by the government not by the insurance companies so they don’t have any bias as to putting people in one plan over the other. I agree with your sentiment about seeking help and support in picking those plans, but I’m not sure that’s the place I would send someone for support.

Abigail: That’s why we’re having this conversation to talk about different perspectives. I work with a handful of insurance brokers who I have personally vetted and are now familiar with metastatic breast cancer because they’ve assisted a lot of people that I have worked with. Having those connections and knowing if there are people in your community who are doing some of these things can be key.

But thank you for that caution, Monica, because that’s also important to remember who you’re talking to and who they’re employed by. You might get a very different answer from an insurance broker versus a social worker who is employed by your cancer center. Getting different input can be important.

Gregory: You have to educate yourself. You have to go through due diligence to ensure that you understand your situation. I’m more aware of my needs now going forward as opposed to before because it was something that I wasn’t interested in. Make sure that you educate yourself and do your due diligence because those two things can save you thousands of dollars going forward.

As we’re navigating this system, how we embody that power can make a big difference in navigating cancer treatment.

Abigail Johnson

Empowerment

Abigail: The word empowerment gets thrown around a lot. We need to understand how we’re looking at empowerment because there are multiple definitions of empowerment.

One definition, that makes me itchy, is that somebody is giving you power. The second definition, which doesn’t make me as itchy, is that we all have inherent power as people and as patients. As we’re navigating this system, how we embody that power can make a big difference in navigating cancer treatment.

Gregory, how do you look at empowerment? How have you gotten in touch with your power as an individual and as a patient?

Gregory: When I was diagnosed, I realized the importance of my purpose in life and the importance of rekindling my faith in the Lord Jesus Christ. My empowerment came back through not only my connectivity to my spirituality but also through my family, friends, and the congregation of people who follow me on social media who were there to lift me.

I took that empowerment and tried to be a beacon of hope and inspiration, uplifting people’s minds and souls when they go through a horrific experience, and letting them know that they’re not in this alone. There’s unconditional love out there, even if you get that unconditional love from a stranger who gives you power and uplifts you to be able to weather the storm and be able to move forward.

Abigail: Thank you for that, Gregory, that was beautiful. Monica, would you like to chime in on this whole idea of empowerment and how that fits in with what Triage Cancer does?

Monica: It’s not my job as a cancer rights attorney to give somebody else power because that power is theirs. But what I can hopefully give people is the knowledge that they need. Knowledge is power.

You shouldn’t have to have a law degree, a project management background, or a million people surrounding you and lifting you to be able to survive this disease with your homes intact, your jobs intact, your insurance, and overall financial health. Yet, unfortunately, because of our system, sometimes that is what’s needed. We want to walk side by side with people and support them through education and providing information so that they can then take that and use their power.

I took that empowerment and tried to be a beacon of hope and inspiration, uplifting people’s minds and souls when they go through a horrific experience, and letting them know that they’re not in this alone.

Gregory Proctor

Gregory: That’s very, very powerful. As we talk about education, you need to seek others who have endured and weathered the same storm that you’ve gone through. A lot of times, people say that may not be a good idea or maybe that is a good idea.

For me, that became one of the circumstances that my wife and I were able to glean from others who are five-year survivors, 10-year survivors, and 20-year survivors and understand how they made it that far. Of course, now drugs and everything has changed, but knowing how they weathered the storm became a tremendous, valuable lesson for us.

Abigail: That’s a wonderful comment, Gregory, this idea of seeing examples of other people, which is what we’re doing and what The Patient Story does all the time as well.

Key Takeaways

Abigail: Know who you are. Allow your strategies and how you figure out how to pay for cancer to flow from who you are. You’re doing something that’s not you. It’s not going to work so well so know who you are.

Knowledge is power. Knowing how to navigate things, knowing the right things, and sticking to your guns in that context can be extremely helpful.

Don’t take no for an answer. Keep going. Keep pushing. Keep asking questions.

Don’t forget to ask for help and collect those people who you can ask so make sure that you’re saving the link to Triage Cancer, which is TriageCancer.org.

Watch for other patients who are navigating this, jot their names down, and know that you might be able to reach out to those people for help. That list can include social workers, nurse navigators, and professionals who do these things that you’re trying to do.

Vote with your feet. When your insurance policy doesn’t cover what you need, vote with your feet. If your doctor is not going to bat for you and not going to do that peer-to-peer discussion, vote with your feet. If you know that medication is way too costly and there’s an alternative, vote with your feet.

We have these choices and to vote with our feet can be extremely helpful and maintain that quality of life to fit cancer care into our lives versus the other way around.

Knowledge is power. Knowing how to navigate things, knowing the right things, and sticking to your guns in that context can be extremely helpful.

Abigail Johnson