How Does Health Insurance Work for Cancer Patients? A Lawyer Explains It All

Abigail Johnston was diagnosed with stage 4 metastatic breast cancer after she found a lump in her breast.

After transitioning from a busy career to going through cancer treatment, she started her own nonprofit, Connect IV Legal Services. She recruits lawyers to do pro bono work for people with stage 4 cancer.

In this conversation, Abigail uses her experience as both a cancer patient and a professional lawyer to answer common questions about health insurance and cancer care. She also offers her top tips for getting the most out of your health insurance plan.

She talks about the different types of health insurance, the role of insurance brokers, CPT codes, the importance of understanding your insurance policy, and financial assistance programs for cancer treatment.

Does My Insurance Cover My Cancer Diagnosis?

This interview has been edited for clarity. This is not medical advice. Please consult with your healthcare provider for treatment decisions.

Cancer Health Insurance – A Lawyer Explains Top Tips & Resources

Introduction

It’s been more than 20 years since I graduated from law school and I’ve been a licensed attorney in Florida ever since then.

I [practiced] different types of law, [including] personal injuries [in] the beginning so [I was] dealing with people who had car accidents, medical malpractice, or some product hurt them, that sort of thing.

Over time, I transitioned into family law, [which] had to do with divorces, child custody, alimony, [and] all of those things that happen when a family is legally dissolving. [From] there, I got a lot of exposure to Medicare, Medicaid, and Social Security, not always knowing exactly what was going on in those situations and having to figure it out and troubleshoot it. That all served me very well when I was diagnosed with stage 4 metastatic breast cancer in 2017.

I like to call myself a professional patient at this point because, basically, I go to the doctor and that’s my job, as well as taking care of my kids. From going to the doctor maybe once a year to a specialist doctor’s appointment once a week, it seems like sometimes, that was a really big adjustment.

Dealing with all of the stuff that came with that on a personal level, I started seeing so many of the things that are broken in our system and how hard it is to access care.

That led me to start my own nonprofit, Connect IV Legal Services. I recruit lawyers to do pro bono work for people with stage 4 cancer. I also run legal clinics. As I began to talk to many people, I started seeing a whole lot of trends in questions, issues, and solutions.

Different types of health insurance

Health insurance can be divided into two buckets, private and government, and that [has] to do with which entity is paying.

Private health insurance

Most people get private policies through employment, whether your employment or your spouse’s employment. When that’s not a possibility, through the Affordable Care Act, there are health insurance companies that participate in the marketplace. You can always go directly to a health insurance company and get a private plan, whether that’s through the marketplace or not.

The good thing about the marketplace is that there is [a] structure in terms of what has to be covered and opportunities to get subsidies that usually depend on income.

The challenge for the marketplace generally is that every state is completely different. Some states will have one participating provider, other states will have more so there will be some more competition. The marketplace can be complicated.

Continuation of health coverage (COBRA)

For people who have left their employer, there is COBRA coverage, which is supposed to cover you for up to 18 months after you leave a position.

Government healthcare programs

Government plans have different types of structures.

Medicaid is tied to income. The program is usually offered to people [whose] income is tied to the poverty level. How that is evaluated usually is the poverty level times 100% or times 400%.

Then you get to the point where Medicaid is both federal and state. Some states have expanded Medicaid, some states [don’t] — that can be super complicated and is usually where you need a social worker to help you figure out exactly what you qualify for [and] which programs you don’t.

You can access Medicare through Social Security disability. For people who have been diagnosed with a serious illness, there’s a five-month waiting period for Social Security disability. Once that five-month waiting period has expired, you have 24 months before you are eligible for Medicare.

If you’ve been diagnosed with a serious illness like metastatic breast cancer, five months [after] your date of diagnosis, you’re eligible for Social Security disability. Then 24 months later, theoretically, you are eligible for Medicare. You have to have applied for Social Security disability. You can’t just sit around and wait. In order to qualify for Medicare, you need to apply for Social Security disability.

Medicare has a whole lot of parts. Part A is offered for free once you’re eligible for it and that covers hospitalization. The nice thing about that is you can have Medicare Part A and private insurance at the same time, which is what I have.

I have my private insurance through my husband and then I have Medicare Part A. I go to the hospital and pay zero because Medicare covers whatever my private insurance doesn’t cover. It’s a very seamless process. It works great for me.

Once you get to B and I think all the way to M, they cost money. You can also get Medicare based on your age. You start getting different types of benefits.

Once you hit 65, sit down with a Medicare broker. For those of us in the metastatic cancer community, our treatments, our medication, our doctors, [and] our scans are all in the top tier, the things that cost the most.

You may have heard of the donut hole. A lot of people who went on Medicare and thought that they had coverage for medication realize that there was this hole. The most expensive drugs were not covered or not covered without a really significant out-of-pocket cost.

Insurance brokers

Should cancer patients use an insurance broker?

I always recommend working with a broker because this is what they do. They have you list your medications, your doctors, and your scans then they refer to your policy to explain what you’re covered for.

I know some people sign up for one thing for the first six months and then sign up for the second thing for the second six months because there [are] different benefits to different parts.

Insurance brokers who specialize in Medicare are paid by the plans so you pay nothing out of pocket. I believe [they] are really key in designing coverage that will actually cover what you need to have covered.

How do you find an insurance broker?

I believe all insurance brokers have to have a license. You can always Google “insurance brokers in my area” with your zip code.

I recommend that you look for a broker that specializes in Medicare and then I suggest you ask, “How many people with metastatic breast cancer have you worked with?” It really is a bit of a niche.

I have some insurance brokers that I work with and I send the people with MBC to them because I know that they have done the extra work to really understand metastatic breast cancer.

There are also brokers in the marketplace so they would help you design or pick the right plan within the marketplace as well. A Google search would usually give you somebody.

I also recommend that you ask the social workers or nurse navigators at your cancer center. A lot of times, they’ve worked with people and developed relationships with brokers that have some kind of expertise or extra training.

Financial assistance programs

Most pharmaceutical companies will have a foundation and specialized copay assistance programs.

Copay assistance programs are designed to help you with your copay. We’re in that top tier. Even if you have an amazing health insurance policy, a lot of times, based on the negotiations between the pharma companies and the health insurance company, you may have a significant copay.

If you have private insurance, the copay assistance programs can come in and defray that cost. Quite frankly, I think that’s the least that they should do because the amounts of money that are being paid out by health insurance companies are pretty significant.

Pharmaceutical companies put [in] a whole lot of time, effort, and money. They expend that in order to develop medications so the price points are set based on how much they had to put in.

When you have private insurance, you have access to these copay assistance plans. In my experience, typically the pharmacy where you get your medication filled can help you apply for those things. Otherwise, it’s a pretty easy process.

The problem many people encounter is when they are on either Medicaid or Medicare, [they] no longer qualify for those copay assistance programs. The reason for that is how Medicare is able to negotiate with the pharmaceutical companies on behalf of everybody in Medicare.

There are certain perks that are no longer offered because they’ve already negotiated as a good rate as they can with the pharmaceutical companies. At that point, some people will get a $2,500 or $3,000 monthly copay until they reach out-of-pocket maximums.

Understanding your insurance policy coverage

Regardless of what insurance company [or] policy — government, private, COBRA — the most important thing that people need to know about what they have is what it covers.

Most insurance policies are going to be hundreds and hundreds of pages long. Typically, you can get that directly from the company. They are usually in PDF so you can search for keywords.

Deductible

There [are] a couple of key things that I think everybody should know. Number one is your deductible. That’s the money that you have to pay every year before you hit your out-of-pocket maximum before sometimes some benefits kick in.

There may be more than one deductible. I have a deductible that applies to doctor’s visits. I have a deductible that applies to medication. Different numbers. I have to meet both of those. I have to pay both of those things before my insurance kicks in.

Out-of-pocket maximum

The second thing that’s super important to know is your out-of-pocket maximum. I doubt there [are] plans that don’t have this. You have to pay up to X amount and then the insurance kicks in either at a different level [or a] different percentage.

Between your deductible and your out-of-pocket maximum, that’s what you’ve got to plan to pay throughout the year before the insurance coverage typically kicks in at a higher percentage.

Sometimes you can have what’s called coinsurance — that’s usually hospital stuff or procedures. But your deductible and your out-of-pocket maximum are the two things that you really should know and have in your mind.

Number one, you have to budget for that. Number two, it’s really nice to be able to walk into a doctor’s office and be like, “Nope, I’ve met my out-of-pocket maximum. I don’t have a copay today. I don’t have anything to pay.”

Limits on scans

In addition to knowing those big picture numbers, knowing other numbers like what kind of scans and how many will my insurance cover.

Medicare is the most restrictive. There’s actually a lifetime limit on PET scans, which many cancer patients get.

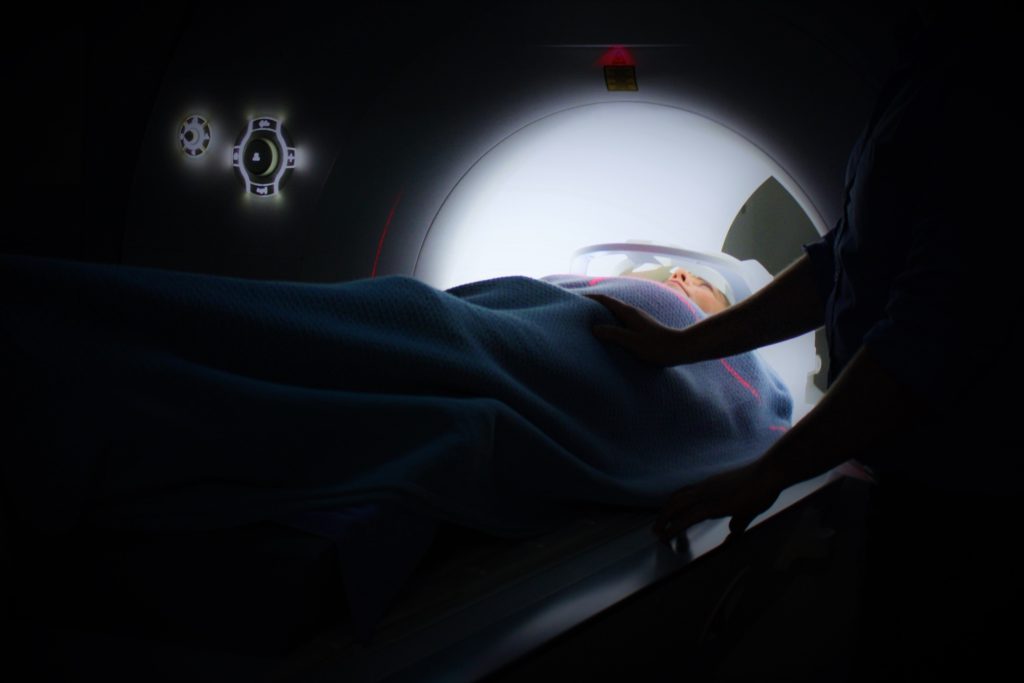

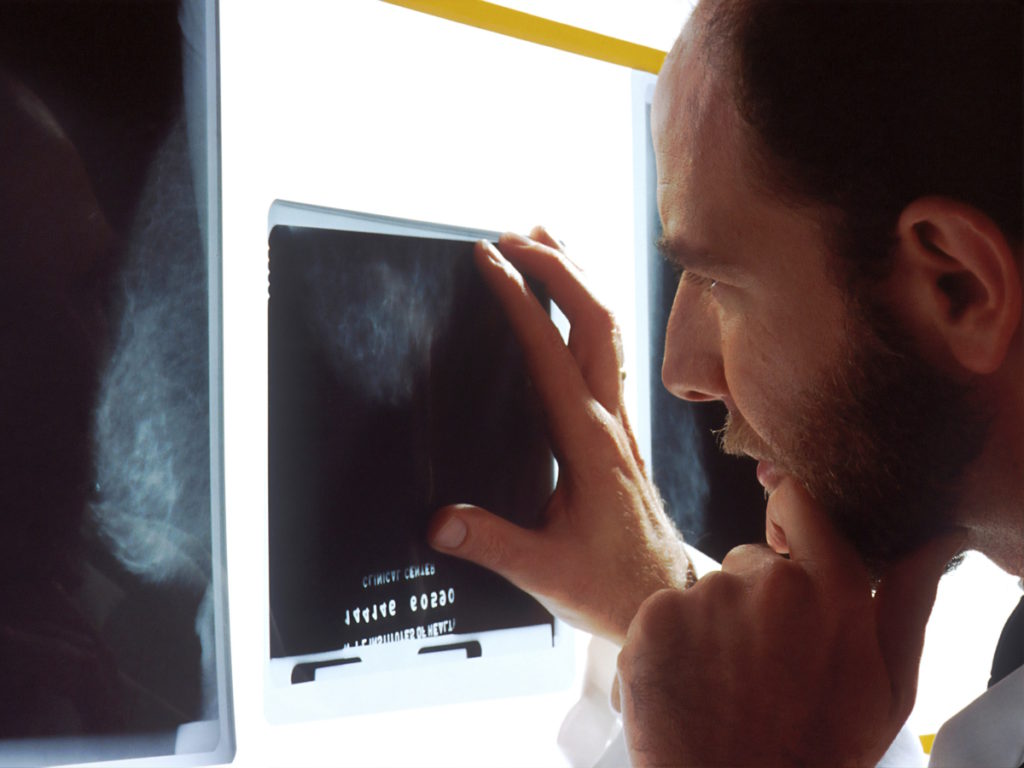

A PET scan is where you are injected with a radioactive isotope that reacts with metabolic activity. Because cancer is really, really active, you have things that light up — or you hope you don’t have things that light up. When you have cancer, things light up and that can give a doctor a really good understanding of how metabolically active the cancer is.

Why would insurance deny a PET scan?

If your doctor orders a PET scan, sometimes — and, quite frankly, a lot of times — the insurance company will challenge that order by saying, “Is this really necessary?” Every doctor’s office I’ve dealt with knows how to deal with that. They schedule [a] peer-to-peer where your doctor is talking to a doctor that’s hired by the insurance company.

Peer-to-peer review

Here’s something really important. Your plan says what you are entitled to in that peer-to-peer discussion.

What’s a peer? The first peer-to-peer conversation that my medical oncologist had, who had 30-plus years of experience, was talking to somebody who is a family medicine doctor who had been out of medical school [for] five or six years. Are those peers? I don’t think so.

I objected. Unfortunately, my doctor had to do the peer-to-peer a second time, but they actually provided an oncologist with a similar level of experience.

As a person who is paying the premiums, typically, that is in your policy. You are entitled to have the insurance company pay for a peer to talk to your doctor. In my experience dealing with a lot of these and my own personal experience, when an oncologist is talking to another oncologist, things don’t get denied as frequently.

When your oncologist is talking to somebody who has a specialty that’s different from oncology, there’s a huge amount of education that has to happen. Your doctor should not have to spend time justifying the treatment plan.

They should be able to talk to somebody who understands what they’re talking about. That is different from if you’re trying to do something experimental, but, at a basic level, you are entitled [to] your doctor to be able to talk to a peer.

Typically, when an insurance company denies something that is standard of care or is typically done, that’s it. They have [a] peer-to-peer discussion, it’s approved, and it goes forward. If it doesn’t, then there are other things that have to happen.

Before many insurance companies pay for a PET scan, they will require a bone scan and a CT scan. [With] a bone scan, you’re ingesting some kind of radioactive tracer that reacts with different things in your bones so cancer, instead of lighting up on the scan, shows up as black. Sometimes MRIs then are ordered to look at the organs more carefully.

This is the thing that I’ve heard from doctors. Doctors like different scans. They like looking at different scans. They like comparing different scans. If you’ve already always had one kind of scan, they like to look at that other kind of scan.

Your doctor is going to be the one to know what scan they need in order to see what they need to see. They will work with your insurance company the best they can to get the images that they need in order to make good decisions.

I know that some people get really, really, really upset when they can’t get a PET scan because their insurance won’t cover it. Doctors know how to deal with this. Whereas some doctors think PET scans are the gold standard, they also can work from a CT scan and a bone scan.

The biggest thing with this is not to worry as a patient. The doctor is going to do what they need to do to get the scans that they need to get you the care that you need.

Yes, insurance companies are a bit of a gatekeeper when it comes to this, but if it’s really necessary, your doctor or their office knows how to get things covered.

The healthcare system is hopelessly confusing and hopelessly broken in so many ways that we need every advantage we can possibly find in order to navigate all of it.

The thing that I’ve learned [from] all of this is that everything’s negotiable. If you need a particular test or scan and your insurance company is not cooperating or your doctor is struggling to get things approved, call up companies, ask for a reduced rate, and ask for them to waive their fees.

Even if you have private insurance, ask for Medicare rates because those are usually lower than health insurance is able to negotiate. Medicare is negotiating on behalf of millions of people so they can get better rates. A lot of times, there’s a lot of room to work with if you need a particular thing done.

Another thing that I’ve noticed is when a particular medication or procedure is approved by the FDA, it can take a little while for that medication or test to be added to the list at your insurance company. If it’s a medication, it’s called a formulary.

[If] something is approved by the FDA, it probably won’t be added to the formulary for a couple of months. Sometimes, that can create some delays for patients. “Hey, this new medication just got approved by the FDA. I want to get on it right now. I’ve been waiting for it.”

Unfortunately, that can mean a bit of a delay just because it does take some time for health insurance companies to get all the information they need from the pharmaceutical companies into their formulary, figure out how much all the costs are, [and] do all the negotiations.

It can be a really complicated process. In that particular situation, that’s where the foundations that are attached to the pharmaceutical companies can often get you some supply before they work out all those kinks.

Current Procedural Terminology (CPT®) codes

In order to get reimbursed for the things that they’re doing, they have to use a CPT code. Every procedure, medication, time, or anything they want to get reimbursed for, there’s a code for that.

There’s been a recent controversy where some of the CPT codes changed. There’s a particular surgery called the DIEP flap surgery that a lot of people who are getting mastectomies and reconstruction like to get. In the way that they changed the reimbursement schedule, it means that doctors will probably no longer offer that surgery and so a lot of people are very concerned about that right now.

There is a separate, administrative body that sets not only the CPT codes but also recommended reimbursement rates. Once that’s been set, the coders in the doctor’s office send a billing document. Then they have the CPT codes and they’re billing for whatever procedure was done.

Now, these coders are doing this all day long. These are human beings. They’re selecting codes and, hopefully, it’s correct.

For those of us who are having the same visit every month, the same blood work every month, saving those explanations of benefits that you get from your insurance company, you can spot trends. You can [see] what they’re billing for every single time so if they’re suddenly billing with a different CPT code, you can see [if] that was something they did incorrectly.

Setting up payment plans

Every single doctor’s office and medical practice is set up to do payment plans. If you need to spread out paying for your medical bills at $20 a month or $5 a month, whatever payment plan you can afford, setting that up in advance is always better than getting a call from a collection agency.

Talk to your doctor’s office and say, “How can we do this? How can we set up a payment plan?” Then you’re meeting an out-of-pocket maximum by spreading out those payments.

I have not heard of any medical practice that won’t waive interest if you’re consistent with your payment plan. Ask if they would waive interest so it’s not like you’re financing a debt. You’re just on a payment plan until you pay it down.

Most, if not all, cancer centers will have a financial aid office. Sometimes it’s run through a chaplain’s office or benevolent office. Just like pharmaceutical companies, about every major cancer center has a foundation attached to them.

Now, a private doctor in private practice may not have a foundation, but you can bet — and it’s a sure bet — that they’ve worked with people who have financial struggles because of medical treatment. Approaching them upfront and saying, “Look, this is going to be an issue,” and working out a plan is one of the best possible things you can do.

Social workers are the ones who usually have the most information on what local organizations provide financial assistance for patients. There are lots of them. Social workers are a great point of contact.

Sometimes a nurse navigator will have some of that information as well. Start with the place [where] you receive your medical care from and work with them on how to meet those bills.

Financial assistance from cancer organizations

There are organizations that have various funds. The American Cancer Society has a fund. If you get on their mailing list, then you find out when that fund opens.

There are many different funds. Some will be specific to, say, people of color, people with MBC, or moms. Whatever the particular circumstances are, get on those mailing lists so that you know when there is a fund opening.

Living Beyond Breast Cancer also has various funds — some focused on MBC, some focused on young women, etc. The Susan G. Komen organization also has some funds available.

Universally, what happens with these funds is that they open and close pretty quickly. Everybody’s waiting for them to open so that they can apply.

There’s a wonderful organization in the northeast called Infinite Strength that specifically focuses on financial support for single moms with metastatic breast cancer. You have to have a child under 18 in the home. The Cancer Couch typically just funds research; that’s another place where people will raise money.

There [are] a couple of other organizations that will fund very specific things. It will fund, say, just medical costs or just your mortgage, utilities, etc. There’s something called the Pink Fund out of Michigan that’s pretty much funded by the Ford Corporation. They also provide funding.

Every single one of these organizations has an application process and most are related to household income. People at 100% or 400% of the poverty level seem to be the range that I see.

Then there [are] other places where you say, “I have this diagnosis,” and they give you a gift card or they give you $100 whenever their funds open.

Unfortunately, there’s no place where all of this information is kept. Most people who are in this situation are looking at every different possibility. Some social workers will be a really good contact for that.

At the end of the day, cancer is expensive and financial toxicity is real because there’s only so much money to go around.

I think one thing that is very important for everybody to know is that as a consumer, you are protected by the Fair Debt Collection Act. If you are being called, i.e., harassed, by a collection agency or even by your medical office, if you say, “I dispute this debt, I do not owe this debt,” for whatever reason — you don’t even have to give a reason — they are no longer allowed to call you, harass you, [or] send you letters.

They have to stop or they incur fines. The only thing that they can do, at that point, is [to] file a collection lawsuit against you, which is something that most are not going to do unless it’s a large amount of money.

Don’t keep taking the harassment. If you’re being harassed and you legitimately cannot pay a bill, simply explain. “I don’t agree with this bill. I don’t agree that I owe this. Please stop calling me.” They have to stop harassing you.

Way down the line, bankruptcy is an option. I think I saw a statistic that over 60% of bankruptcies in the United States are filed because of medical debt. That is probably one of the big reasons why most medical offices, cancer centers, etc., will enter into payment plans with people because they know if they don’t, they’re going to get nothing and something is better than nothing.

There [are] a lot of options and different possibilities. The one thing they cannot do is refuse to provide care. If you are going to a cancer center and you have bills, they may put some pressure on you to pay them when you go, but they can’t refuse care based on a bill that is pending.

Words of advice

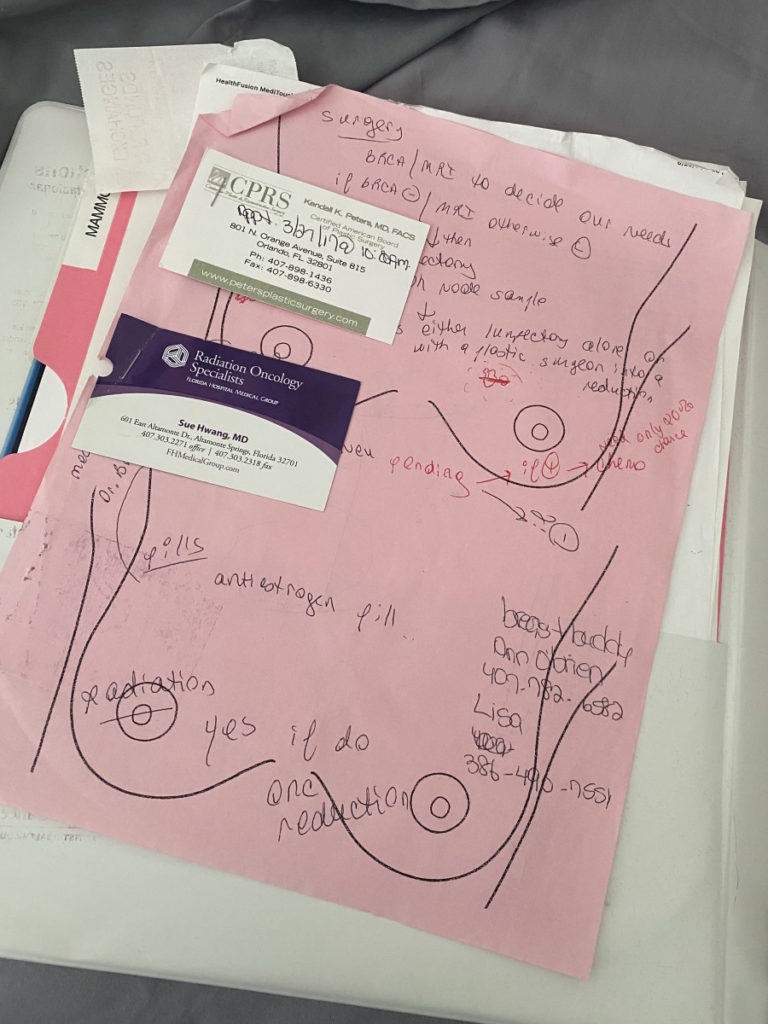

If you have a caregiver or somebody in your life who is looking for something to do for you, organizing the medical piece of things — gathering the information with your insurance policy, keeping track of your explanations of benefits — [is] a great job to give somebody who is organized [and] wants to help.

Have a notebook [when] you’re talking to insurance companies, your doctor, drug companies, whoever you’re talking to. I have a notebook that sits beside my computer. I’m immediately writing down [the] date, time, who I talked to, and what happened.

I always ask for confirmation numbers, whatever can get them back to whatever discussion [we] had. I don’t know about anybody else but once chemo brain happens, there are just things that don’t stick anymore.

Unfortunately, it’s confusing. For instance, my mom went in for chemotherapy. They walk out and they’re like, “You owe us $40,000 or you can’t get chemotherapy. Oh, but by the way, if you cross the street, you’ll pay $50 out of pocket.”

A lot of people don’t understand that prices for medication change based on how you get it, like a pill, injection, or infusion. It’s the same medication but it’s billed [in] different ways.

Then it’ll be billed differently whether you get it in a doctor’s office, in an outpatient center, in the hospital, outpatient at the hospital, [and] inpatient at the hospital. That’s insane because there’s no way any patient could ever know those things except by shopping, basically, or if there’s a social worker who’s very aware of that.

In the situation with my mom, they were like, “Just walk across the street.” Yes, it’s business, but I do find that most of the staff really want to find a solution for the patient. But sometimes, it’s just hopelessly confusing.

There is a bill pending called the Cancer Drug Parity Act that would streamline that for the patient. You pay the same no matter how you get your medicine, no matter where you are. But I don’t know that it will ever pass because it would affect millions of contracts that are being made all the time between all of these different entities.

Part of the Cures Act says that when you get a scan, as soon as the doctor gets it, you have to get it at the same time and that’s usually pushed out in a patient portal.

Medical practices have to be upfront as far as what they’re charging. Typically, when I walk into an urgent care center, there’s a poster and it’s like, “This is what you’ll pay if you have insurance. This is what you pay if you’re paying cash.”

Usually, if you’re having a procedure or getting medication, they will give you an estimate as far as what it will probably cost. Hospitals and doctor’s offices are required now to be more transparent about those things.

If the cost of something is not covered by your insurance policy, [if] you’re going to have to pay some out of pocket, [if] you haven’t met your deductible or your out-of-pocket maximum and you know you need to have a payment plan, these are all things that are good to just ask about upfront. Sit down with the financial person to work out a plan.